hi.

I teach my 450,000 TikTok followers and 190,000 Instagram followers how to invest and trade stocks. Wanna learn more? Check the links below:

I teach my 450,000 TikTok followers and 190,000 Instagram followers how to invest and trade stocks. Wanna learn more? Check the links below:

Lately on TikTok, I’ve been getting a lot of messages on my dividend videos that make me feel like people aren’t quite grasping the staggering long term benefit of dividend investing. Not only that, but the misinformation on dividends, as a finance educator, terrifies me.

If you’re here from the McDonald’s video and you want to learn how that video is actually helpful, scroll to the bottom.

So, in addition to my free investing resource guide, I’ve made this one page document. We’re not wasting any time here. This is …

A dividend is not a return of capital. It is a portion of the company’s profits.

One share of KO as of this article being posted is $60.39.

Coca Cola will give you $1.84 per share that you own. Whether KO stock goes up or down, the $1.84 dollar amount will stay the same unless KO raises or cuts it.

The 3.05% yield you see is a percentage of KO’s stock price. The yield/percentage will change daily as KO’s stock price goes up or down. If KO stock crashes 20%, the $1.84 dividend will remain the same (unless they cut it). But the yield (the percentage) will go up.

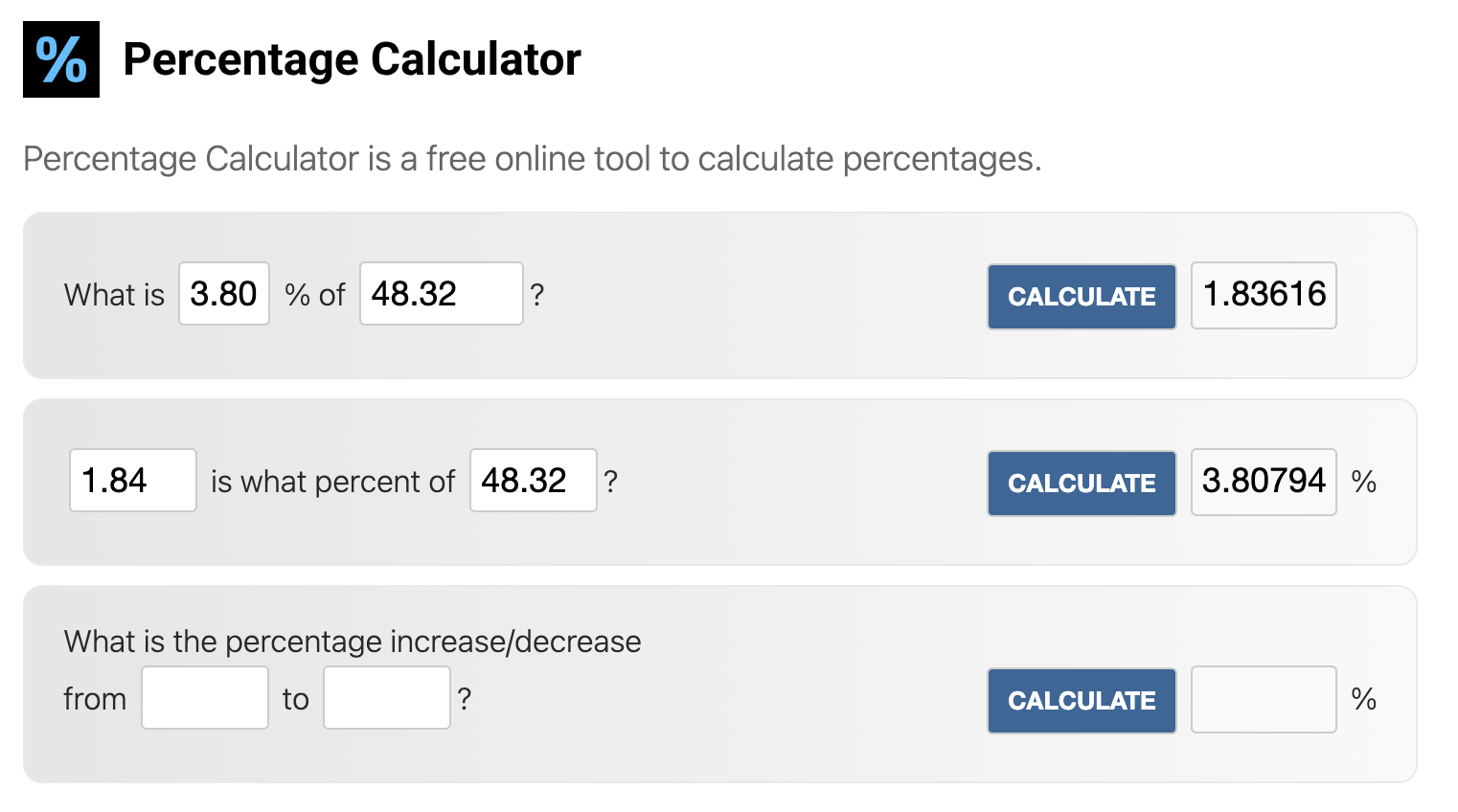

If KO dropped 20%, the stock would go from $60.39 to $48.32. If they maintained their $1.84 dividend, the yield would go from 3.05% to 3.80%

There are several dates related to dividends:

Declaration Date: the board announces the next date when the dividend will be paid

Ex-Dividend Date: the cut off date to be eligible. If you buy the stock ON or AFTER the ex dividend date, you will not get that dividend payment. It’s usually one day before …

Record Date: the date the company checks shareholders to see who owns shares.

Payment Date: the date the dividend is actually paid

High risk dividends include anything over 10%, typically. A high dividend yield can be a sign that the company’s share price has declined rapidly. Inexperienced investors are often attracted to high dividends. That can be a rookie mistake.

Most companies pay quarterly, but some (like REITs) pay monthly.

Cash will be deposited into your account, unless you enroll in DRIP (Dividend Reinvestment Plan).

DRIP will allow you to reinvest your dividends so you can get more shares.

DRIP allows investors to benefit off long term compounding.

High growth stocks typically do not pay dividends.

Large cap established companies often do pay dividends.

Dividends are not meant to offset losses.

Dividends are not “free money.” it takes a lot of shares and a long time to be able to “live off your dividends.”

You can see what percentage of the company's earnings are being distributed via dividends by looking at their Payout Ratio.

A low payout ratio means the company could increase dividends for years to come.

A high payout ratio means the company might not be able to increase dividends, but might mean you’re able to have stable dividend income.

KO’s payout ratio is 69%

There are ordinary dividends and qualified dividends.

Ordinary dividends are what most people get. They’re taxed at your regular income tax rate.

Qualified dividends offer tax incentives but come with strict holding period requirements.

If you invest in dividend paying stocks in an individual account, you will owe taxes on dividends, even if you reinvest the shares via DRIP.

If you invest in dividend paying stocks in a Roth IRA, typically there will be no taxes owed.

People invest in dividend paying stocks for stability as a part of a diversified portfolio. A good portfolio will have a mixture of growth stocks and dividend based stocks, along with ETFs, REITs, and some higher risk speculative investments (typically no more than 5% of your portfolio a.k.a.: Money you’re okay losing).

A high yield savings account, while great for your emergency fund, is not the same as investing in a stock, even if a HYSA pays more than your dividend. High yield savings accounts are at rates we haven’t seen in 20 years. You will not save yourself into retirement. You must invest.

Not to mention: Your HYSA rate will change constantly.

I get an email once a month from my bank saying the rate has been cut. And yeah, this can happen with a dividend company too, but that’s why you want a diversified portfolio (or just a quality dividend ETF). Not ONLY do you most likely get dividend increases but you get asset appreciation as well. In other words: Stock go up.

Due to inflation, you will NEVER consistently, over decades, earn more in interest than the rate of inflation. If you ONLY save, you will end up LOSING MONEY. So if McDonald’s pays 2% and your HYSA currently is 4%, you aren’t better off with the HYSA, especially because MCD has gone up 200% in a decade.

And a part of a diversified portfolio means investing in dividend paying companies or ETFs.

And don’t forget about DRIP. When you reinvest your dividends, you get more shares, which earns you more dividends etc. etc. You don’t get that with a HYSA. You just earn 3-4%.

This is another one of those "social media issues” that is a non-issue. When you get a dividend, the stock price DROPS by roughly the same amount on the ex-dividend date. This is because the company is actually LITERALLY worth that much less in cash. Before the dividend goes out, the cash is on the company’s balance sheet and reflected in the stock price. But once they pay that divvy … well, the company doesn’t have that cash anymore. You do.

So the stock drops BECAUSE it is like an accounting reset that prevents people from attempting a dividend capture strategy: You buy the stock for the dividend, sell the stock the next day and it’s a risk free profit.

HOWEVER … this is a temporary non-issue because stocks don’t trade based on the cash balance. They trade based on earnings guidance and growth. So this idea where people are like THE STOCK WILL KEEP DROPPING EVERY TIME THEY PAY A DIVIDEND are … yeah, kinda’ … dumb. Stocks don’t just keep going down in perpetuity because they pay a dividend because after the dividend is paid, normal trading and investing resumes.

These are SMALL blips that are … yup, a non-issue. In other words … who cares?

Finally, if you’re here because of this TikTok video, you might be wondering how a video that asks, “how much would it cost to make $20,000 a year from McDonald’s dividend,” is actually be helpful?

Most people rush to the comments to say, “thanks! I’ll just use that spare $1,000,000 I had lying around!” or “How is this supposed to help?!” or “You’re out of touch!” or “You the MILLIONAIRES are on TikTok for your advice?!”

Funny sidenote: I have a similar series on how to make $1,000 a year from a dividend and the comments there are usually like, “$1,000 is nothing!” “Who is this supposed to help?!”

Anyway, here’s why that video IS helpful:

In addition to McDonald’s smaller dividend, the stock has had very solid growth over the last 10 years. Had you been investing, consistently and over time, that dividend would have been reinvested, allowing you to compound over the years AND benefit from asset appreciation.

It shows that whether you’re investing in McDonald’s or ANY stock that pays a dividend, you can amass a large position over time through, yes, consistent investing. It doesn’t matter if it’s a stock like MCD or a dividend ETF like SCHD. The purpose is to illustrate consistent investing as a way to generate passive income in retirement.

It helps because it hopefully prevents people from get rich quick schemes. YES, the rich use their money to get richer. But is it wrong to learn how wealthy people use their wealth to generate more wealth? Or is it something YOU can apply to yourself, even on a smaller scale? There’s nothing wrong with learning how the wealthy make their money work for them.

It helps because it forces people to ask better questions, which in a roundabout way, people do actually do in the comments section. They’re just assholes about it (yeah, I’m probably talking to YOU). You ask, “Are there better investments out there?” “Are there higher yielding stocks?” “Are there higher yielding stocks with a lower cost per share?” “Are there growth stocks that have better performance?” “Should I diversify my portfolio to include some growth and some dividend stocks?” “Can you explain why a HYSA is NOT a better option?” Now you’re thinking critically. Thaaaat’s the point.

This video sets realistic expectations. Far too frequently, people imagine they’ll invest a little over time and bam! They’ll have passive income earning them millions per year. This video flips that on it’s head. Actually, you have to invest millions to make thousands (from dividends, not from the stock increasing over time). But if you do it consistently, over time, and invest in multiple investments, you could generate enough passive income to retire. You just need to live below your means, invest and do it consistently. No more fantasies, just real numbers with real math.

Finally, a little cleaning up of misinformation. Many comments on the video said, “So it takes 47 years to pay back your investment.” This is the WRONG WAY to look at dividends. That “47 years to get your money back” take completely misunderstands what dividends are and how stocks work. Dividends are income generated by an asset you still own, not a repayment plan for your original investment. When you buy McDonald’s stock, you’re not lending McDonald’s money and waiting to be paid back—you’re buying a productive asset that can pay you cash while the asset itself appreciates in value over time. In those 47 years, you’re collecting dividends every single year, those dividends usually grow over time and can be reinvested, compounding over and over. At the end you still own the shares, which historically are worth far more than what you paid. Framing dividends as “how long until I break even” is like saying a rental property is bad because rent doesn’t equal the purchase price fast enough—ignoring the fact that the property still exists and usually becomes more valuable.

There you have it. That’s why the video is helpful.