hi.

I teach my 450,000 TikTok followers and 190,000 Instagram followers how to invest and trade stocks. Wanna learn more? Check the links below:

I teach my 450,000 TikTok followers and 190,000 Instagram followers how to invest and trade stocks. Wanna learn more? Check the links below:

I have a new series on TikTok where I am going to sell a covered call against my HIMS stock every single week (unless my shares get called away, in which case I will sell a cash secured put instead, but we’ll get to that later). In doing so, I’m going to generate roughly $180 a week in premium.

$180 per Week Series - TikTok

$180 per Week Series - YouTube

Watch the Covered Call + Covered Call ETF playlist here - TikTok

Watch the Covered Call + Covered Call ETF playlist here - YouTube

A covered call is an options strategy where you sell a call option on a stock you already own. One contract = 100 shares, so you MUST first own 100 shares before you can use this strategy. Typically, the more volatile stocks pay higher premiums. The downside to covered calls is … most of the more volatile stocks are super expensive, which prices out a lot of retail investors from being able to do this.

When you sell a covered call, you're giving someone else the right to buy your shares at a specific price (called the strike price) before a certain date. In return, you get paid a premium upfront. If the stock stays below the strike price, you keep the premium and your shares. If it rises above the strike price, you still keep the premium, but your shares may be sold at that price — meaning you miss out on any gains above it. It’s a way to generate extra income from stocks you already own, but it does cap your potential upside.

The most popular question I get asked is, yeah but … how are you finding the high premium stocks? There are several ways to go about this, and below, I’ll put links to two videos.

Truthfully, as someone who has been investing for over 20 years and trading for $15, I just tend to know what stocks are more volatile than others. Coca Cola? Slow and steady. I can near guarantee without looking that the premiums for KO covered calls are 1% or less, which is great. But I’m here to take a little bit more risk to generate weekly income in the range of 2-4% (if you are adverse to risk, higher quality, less volatile stocks might give you peace of mind when it comes to selling covered calls.

What about HIMS? That stock is in the news every other week with scandals or bad news or good news. High volatility = high risk. But it also = high premium.

But here are a few videos that will help:

The Secret to Finding Covered Call Stocks

How to Use Screeners for Covered Call Stocks

Covered Calls Under $10 per Share: How to Find Them and A Walk Through Example of Selling a Call

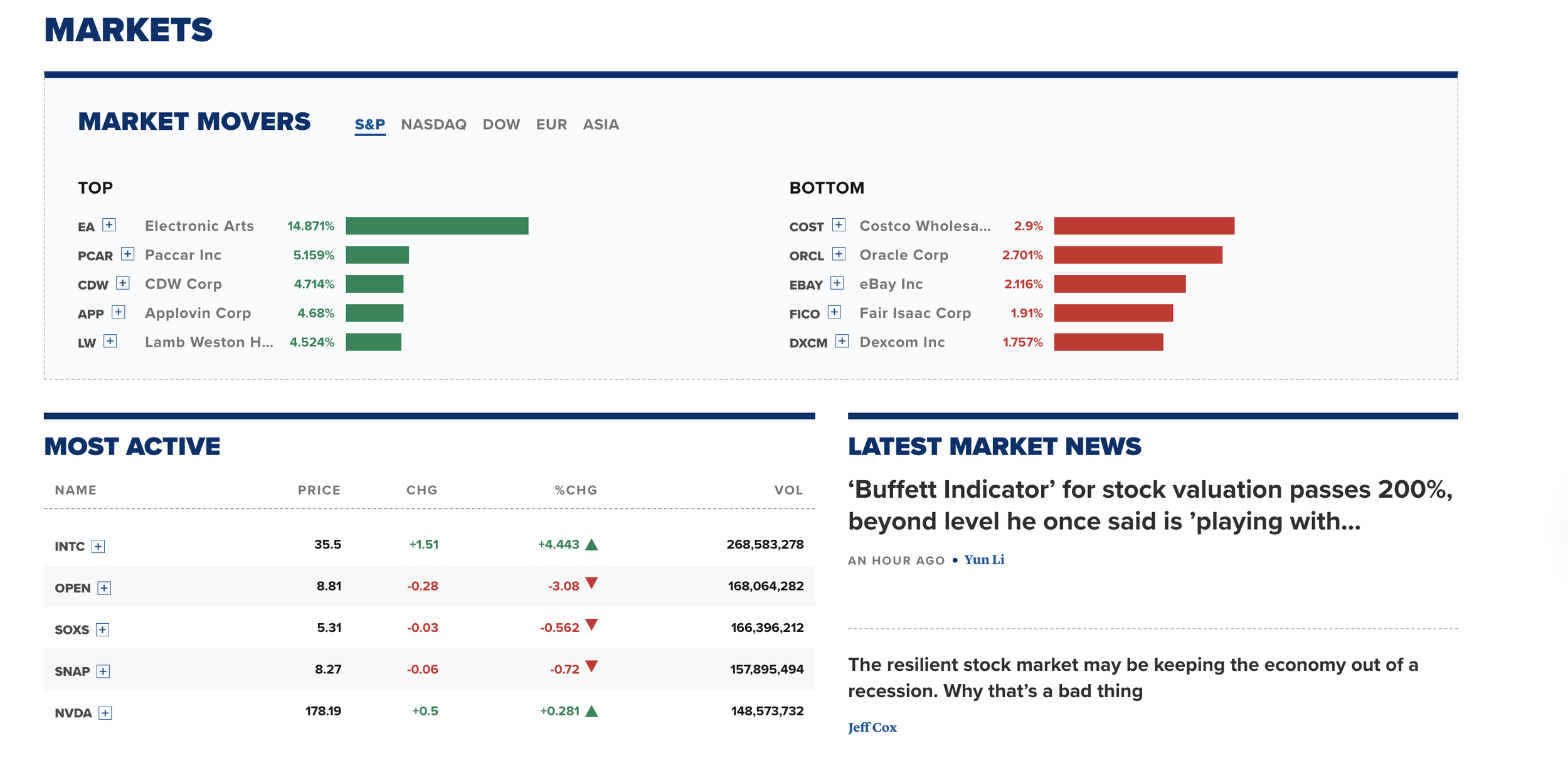

One other way I find volatile stocks to sell covered calls on is by going on CNBC’s website. On their homepage, if you scroll down just a little bit, you’ll find this:

Most active, market movers - top and bottom, and unusual volume. This is a potential goldmine for finding stocks - yeah, even stocks that are dropping.

When "quality stocks” drop due to bad news, that can be short term scary, but a potential buying opporunity if the bad news isn’t SUPER bad. If the company thinks sales could slow over the next several quarters … that’s very bad. If the company says sales dropped last quarter due to something out of their control? That’s an overreaction and the stock could be up in no time.

So, I look at everything. I write down the stocks that are soaring so I can buy them on potential pullbacks the following week. Sell a covered call, earn the premium, (hopefully) get assigned and that frees up money the following week to make different trades.

On the other side of my trade is a person, institution, or market maker who wants my shares. We are making an arrangement.

I purchased 100 shares of HIMS at $56. I sold a covered call with a strike price of $58. I’m paid a premium (which will fluctuate weekly based on the volatility of the stock) to essentially say, hold those shares for me, because if they’re over 58, I get to buy them from you AT $58. They’re paying for the right to buy the shares at the strike price.

I sell my covered calls weekly. The premiums are higher and it gives me weekly income. So every Monday, I sell a covered call that expires on Friday. At market close on Friday, the stock is $62. My shares are assigned, which means they’re gone. They get sold to the person on the other side of this “bet.” Except he buys them at $58 per share.

This means a few things to me: One, I will realize a profit on the shares being assigned. Since I have 100 shares and I bought at $56 and they were assigned (or sold) at $58, I make $2 per share, or $200. I also make whatever the premium was, which as of this writing averages $180 a week.

That means I walk with $380 in profit (minus taxes).

But the other person gets my shares at $58 and the stock is now $62, which gives them a profit of $400 (minus the $180 they paid me for the premium).

You might say, dang! You shoulda’ just traded the stock that week, you would’ve made more if you bought at $56 and sold at $62! I would’ve made $600! But every week is different and just because the stock went up a lot ONE week doesn’t guarantee it’ll do it every week. But the premium I earn is guaranteed.

What if the stock does NOT hit $58 or above? Then, I keep the premium, which means the person on the other side lost our “bet.” I also get to keep my shares. You can pick whatever strike price you want, but the strike prices CLOSEST to the current stock will pay a much higher premium, because it’s riskier for you, the owner of the 100 shares - there’s a higher chance your shares will be assigned.

If I buy at $56 and sell a covered call with a $58 strike price, I am selling “two dollars out of the money.”

So, you make more money from the premium, but run a higher risk of assignment. The further out you go, the safer it is in regards to assignment.

Think of it like this: If I bought the stock at $56 and sold a covered call with a strike price of $57, it would be VERY likely that in one week, the stock could hit $57 and I’d lose my shares. Because of this, I demand a higher premium to make it worth my while.

If I go to, say, $63, the premium will be MUCH less with a weekly expiration because it isn’t very likely that the stock will go up 12.5% in one week. Not impossible. Just unlikely. And because of this, the premium will be much less.

Take a look. To the Far right you see “STRIKE.” You also see that the stock is $58.19. So if I sell a contract just slightly out of the money ($59), the premium is $1.51 or $151 per contract. It’s much more likely it’ll go from $58.19 to $59 in a week. But what if I pick a 65 strike price? The premium is only .28 or $28. You make less because there’s less risk.

Now say it’s Friday and the stock is $58.85 and the strike price is $59, but I bought the 100 shares at $56. It is VERY likely that the stock will close over $59 and I’ll lose those shares.

Since I purchased it at $56, I’m not terribly worried about my shares being called away. If they’re assigned, I’ll just purchase the shares back the following Monday (or I’ll sell a cash secured put - but again: more on that later). I’ll make a small profit, I’ll keep the premium.

But … what if I bought the stock a long time ago when the stock was $10 per share. And I REALLY don’t want to lose those shares?

Why wouldn’t I want to lose them?

I could owe a big tax bill (If I bought at $56 and was assigned at $58/59 I’d owe taxes too, but MUCH less).

I lose my very low cost basis, which I might not want to lose. I might be more cautious in buying 100 shares now that the stock is in the mid-50s.

Here, I would have a few options:

I could BUY BACK the contract by closing it before expiration. You just go to your brokerage, hit the little down triangle and hit “close positions” or “roll positions.”

2. If I’m closing the covered call and I have a loss, it might cost me a LOT of money to buy back the options contract. BUT in doing so, I keep my shares. If doing this is too risky for me and I decide, I don’t want to sell covered calls on something that I ideally want to hold for a long time, I might just close the position and not sell covered calls anymore.

3. If I want to sell another covered call next week, I might opt to roll the position. Rolling the position means I buy back the call (so I take a loss), and I simultaneously sell a NEW call for the following week or whatever date/strike I choose. This allows me to also keep my shares.

The downside is that I might pay more to close the position than I will make on the next week's premium and I am exposed to new risks. Say the volatility cools off next week and the premium isn’t worth very much. BUT! I get to keep my shares.

So, in summary: If I buy the stock at $56 and sell a strike for $58, I’m not going to bother rolling anything. I’ll just take the profit on the sale of the stock and the premium and I’ll buy it back next week.

But if I bought the stock at $10 and it’s $56 now and I don’t want to lose my low cost basis/I want to avoid a big tax bill, then I will consider buying back the option or rolling it if I still want to make the covered call premiums.

One other thing to note: The cost of rolling your option (taking a loss) CAN exceed what you’d make in premium, so it isn’t always profitable, but it is an option you can use if you want to keep your shares.

Say you buy a stock at $55 per share. You sell a covered call with a strike of $56 and you earn a premium of $180. Pretty good. But then something happens. Bad news strikes and your stock drops to $40 per share! Oof.

You might consider the covered call repair strategy.

You don’t MIND holding it at a loss because it’s a company you’re long term bullish on. But … you can’t sell covered calls with a $56 strike anymore because it’s so far out of the money now.

What can you do?

You can sell covered calls with a strike price of, say, $45. You’re asking, “Why not $41? I’d earn a higher premium!” You’d also run the risk of an EARLY assignement (before Friday expiration) if the stock SKYROCKETS beyond $41 earlier on in the week. Then you’d be screwed.

Setting a strike price a few dollars out of the money allows you to make SOMETHING while you wait for the stock to recover. (BTW: If you don’t believe the stock has a chance of recovering, you should either not be trading it due to be chance you could be stuck with it OR you should consider cutting losses).

So, you pick a strike price of $45 with a Friday expiration. A few things happen from here.

The stock doesn’t hit $45. Maybe it hits $44. You keep the shares and the premium and the following week, you sell another covered call with a strike of $49.

The stock hits $47 on, say, Wednesday. If you roll the contract on Wednesday, you might take on a bigger loss to buy back the existing contract and the premium you earn from the new contract might not offset the loss entirely.

There’s also the chance that the stock begins to decline back toward $45 by Friday. It is UNLIKELY (not impossible) that it will be assigned early. Early assignment would only be more likely if the stock really exploded. Two dollars over the strike might not be worth it for the person on the other side to assign it early if there’s still a chance it could drop below $45 by Friday.

What I’d personally do is wait to roll the contract on Friday during the last hour before close (unless the stock rockets early in the morning).

So you see what’s happening here. You’re in at $55, but you can’t sell strikes of $56 if it’s $40. So you sell a call with a strike of $45. You earn some premium. You keep an eye on the stock. If it goes up, you move up your strike a few more bucks the following week, earning smaller premiums, but still earning something, until it fully recovers. Now, the stock is $55 again! You can sell your $56 strike and earn higher premiums.

Now, let’s say you’ve been investing in this company for a while. You have 100 shares at $10 and 100 shares at $56, which you’ve purchased expressly for the sake of selling covered calls. You do not want to lose your $10 purchase price - that’s your long term investment. It’s for the future.

But if the position at $56 is called away, who cares?

Thing is: How do you convey this to your brokerage. How do THEY know which sales to assign if they’re called away?

You have to specify your cost basis method. Here’s how you do it on Schwab, which is the only brokerage I’ve ever used. So if your question is: how do I do this on Robinhood/Fidelity/eTrade, etc.: I have no idea. Call them and ask.

But on Schwab, you click on the profile tab:

Then you click on the COST BASIS METHOD:

And once there, you’ll see this:

Now the position you bought at $10 was your first investment years ago. So, the default method is FIFO: First in First Out. But you don’t want that, right? You want to hold onto the shares you bought at $10. So you go here and you hit LIFO: Last in First Out. That means when your shares eventually DO get assigned, your brokerage knows to sell the position you bought most recently: the shares at $56.

NOTE: Some brokerages might allow you to assign your shares during the transaction or retroactively. Schwab doesn’t, which is why I have to set it up this way.

Ok so now let’s say you buy an entirely new position strictly to sell covered calls. You buy 100 shares at $56. You sell a covered call with a $58 strike price. The stock price rockets to $64 (or simply just lands exactly on your strike of $58.00) on the day they expire. Your shares are assigned.

You keep the premium AND you keep the profit from 56-58. You unfortunately miss out on the profit to $64 or whatever. But that’s the game.

Now you want to do this all over again. But you can actually make money selling a cash secured put, too. The put is a bet that the price will go DOWN (and like the calls, they can expire weekly or on any time frame). Here, too, you earn a premium. And the “cash secured” part means you have the money to buy the shares if the stock does drop to the price you thought it’d drop to.

So, say the stock rockets to $64. Your shares are assigned. You say, okay, there’s no way this stock will drop to $56 again, at least not next week. But it COULD drop to $60 if people step in to take profits.

You also happen to have $6000 (the cash is secured - you have the money ready). So, you sell a cash secured put with a $60 strike price.

Now you’re making the bet: I bet this stock will be 60 next week and if it hits $60, I’ll buy it.

The person on the other side is paying ME a premium because he’s saying, no matter what, if it’s $60 or below, YOU HAVE TO BUY IT AT $60.

So, say the company has some terrible news and the stock drops to $51. I am obligated to buy it at $60.

If the stock closes at $60.01 or anything above $60, I am not obligated to buy the shares anymore AND I get to keep my premium.

Of course, there are huge risks involved with this strategy, too. I might have to buy the stock at $60 even if it’s $51. Buuuut, I get a premium. So I might roll the dice and say, Well: I don’t THINK anything bad will happen this week, and I’d rather make some money. I’m basically being paid to wait and buy the stock at the price I want to pay.

Now, I might say, Hmm. Earnings are coming out next week. And I just don’t know. The economy is fragile/that sector is risky/the competitor had bad earnings last month … I might say, skip the premium, it’s not worth the risk. I’ll just sit on the sidelines and wait and see what happens next week. Then I’ll buy back the 100 shares whenever I’m ready and sell covered calls.

However, this strategy is called the wheel. You:

Buy 100 shares.

Sell a covered call.

The shares are maybe assigned, you make the profit + premium.

You sell a cash secured put.

You make the premium + you might get the shares back at the lower price you wanted

You have 100 shares again, so you …

Sell a covered call.

You do this over and over again and it is a wheel.

To sell a Cash Secured Put you need to remember: If assigned, you’re on the hook to buy 100 shares, which means you need that cash sitting in the account. It is the exact opposite of selling a covered call.

You go to the options chain, and under the PUT side, you hit “BID” on whatever strike price you want, then drop the pulldown tab to 1 since you’re selling one cash secured put, and then confirm your order.

You can ignore “MAX LOSS” - that’s just the computer reminding you the max loss would be 100% if the stock went to zero.

So in this case, the stock is currently $59 and I’m selling a Cash Secured Put at $58, which means if it drops to $58 by expiration, I’m on the hook to spend $5800, but I will also earn $117 in premium to do something I was going to do anyway: buy the stock if it drops to $58.

One other thing to note: If you sell a cash secured put and the stock crashes before expiration, you can ALWAYS buy back the option. So, say the stock is $65, you say, “I’d love to buy the stock at $63.”

You sell a cash secured put.

But then the stock drops to $52. Uh-oh! Does this mean you HAVE to buy the 100 shares at $62? No. You’re not REQUIRED. If you let the contract expire, then yes, you’ll buy the shares t $62 even if it’s $52 now.

But you have an option, which is to buy back the contract before expiration. The downside is that you will buy back the option at a much higher price, which means you’ll lose money on that. But you won’t be required to buy the shares at $62.

If a stock has had a huge surge in price - say it went from $10 to $18. I think a pullback or a correction could be imminent or perhaps people just step in and take some profits … the thought process is: I want to buy this stock at a lower price! I will sell a CSP with a strike price of, say, $14, since that’s where I think the stock is going.

But the PREMIUM on a stock that far out of the money will be TINY. I’m talking about $10 in premium. Why would I set aside thousands of dollars to make a measly $10 per contract when I could use that money to BUY a different stock instead, sell the call, generate a much higher premium, potentially get assigned all in the same week and then check back in on that stock that I wanted to buy at $14? If it’s $14 or thereabouts, I’ll just buy it then.

To me, that is a MUCH better use of my money.

Why I don’t like Cash Secured Puts: This reason and also this reason.

In the screenshot right above, you’ll see four columns at the top of options chain: “DELTA, GAMMA, THETA, VEGA.”

These are “the greeks,” and people who trade options swear by these measurements.

Simply put:

DELTA is a rough estimate of the probability that your option will end up in the money and your shares will be assigned.

The stock is currently $50.40. If you go to the $51 strike price, you’ll see the delta is .41. This means there’s a 41% chance that the stock will close above $51 and your shares will be assigned.

If the delta was .10, then it’d be a 10% chance based on stock price, time to expiration, and volatility. It is NOT a guarantee.

GAMMA is not super popular, but it just measures how much delta changes with every $1 move of the stock price.

THETA measures how much value the option loses each day due to time decay. Time decay is your FRIEND. Options are like those countdown clocks. The closer to expiration, the higher the theta. And if you’re selling covered calls, that is GOOD for you! The option loses value and if it expires worthless, you keep your shares AND the premium. Win-win! Of course, the stock could suddenly surge right before the close - again, no guarantees here with any of this.

VEGA measures the sensitivity of an option’s price to changes in implied volatility. IV is super important in the options world. The higher the IV, the higher the premiums. The lower the IV, the smaller the premium. Since I am personally selling covered calls strictly for higher premium, the higher the IV, the better. If IV drops after you sell the call, that’s a benefit to me - this is called IV CRUSH. It means I’ll most likely keep my shares and the premium. If IV spikes, my shares will likely be assigned. If I care about this, that could be bad and it could mean that I’d pay a lot of money to buy back those options before expiraiton.

But again, since I’m just using this strategy for income, I don’t care if the shares get called away.

Here’s how to add Implied Volatility to your options chain:

For me, the most important metric is IV and delta. If I was worried about losing my shares, I’d look for the lower delta. Since I’m here just to make money off this, the higher the delta, the higher the premium. If the shares get called away, no biggie.

You can buy back the option before expiration if you’re happy with your profit and worried that some good news could come out and pump up the market. Say you sell a covered call with a $57 strike and it’s $54 currently and you’re showing a profit. It might not be the full amount of your covered call premium, but it might be close … and you might say, hey, this is close enough. You could buy back the contract on any day you wanted and lock in a gain, albiet a smaller one.

INDIVIDUAL STOCKS

Another risk with covered calls is that you are working with often very volatile individual stocks. Individual stocks can go up a LOT, but if you’re doing this strategy, your gains are usually capped.

Say, for example, you buy 100 shares at 50, sell a covered call with a $51 strike price and a week later, the shares hit $60. Your shares are sold at $51. Oops. Now, you still make a profit on the $1 gain and the premium, but you miss out on the rally.

You might not care - some weeks, the stock will surge and hind sight, you might say damn, shoulda traded the stock that week. But YOU DIDN’T KNOW that was gonna happen. Either way you slice it, some risk is involved.

Speaking of which, what if you buy the stock at $50, sell a covered call at $51 and the stock drops to $42. You keep the premium, but now you have a loss on the stock. If you sell a covered call here, the premium would be insanely small if you went to $51 because you’re so far out of the money (away from the strike price - if it’s 50 to 51, you’re $1 “out of the money.” Because the strike is so close to the price you paid ($50), the premium is higher.

But if the stock is now $42, the premium is either going to be insane, or you COULD run a huge risk and sell a covered call with a $43 strike price. You’d earn a higher premium because you’re only a dollar out of the money, BUT: If the stock closes at $43.00 or above, your shares are assigned at $43 … even though you bought the stock at $50, which means you end up taking a LOSS.

EARLY ASSIGNMENT

One of the rare cases where shares might be assigned before expiration is when the company you’ve sold a covered call on pays a dividend. For example: you sell a call on Monday that expires Friday, but there’s a dividend coming on Thursday and the ex-dividend date is Wednesday. The option buyer might choose to exercise on Tuesday, so they’re holding the shares in time to collect the dividend.

In that case, your shares get called away early. You don’t get the dividend, but you do keep the premium. It doesn’t happen often, but it’s something to watch for — especially if your option is already in the money and the dividend is juicy enough to be worth the early exercise.

LOSS SHOWN

Say you sell a covered call and you earn a premium of $143, but you want to buy it back before expiration. Maybe the stock surged in price and these shares are ones you really want to hold onto.

On your brokerage page, you might see a loss of $257. You hit the “buy to close” option and you see the total cost to buy back the option is $400.

$400 is the cost to buy it back

-143 is the premium you earned

$257 is what your brokerage is SHOWING as a loss.

DIVIDEND STOCKS

Typically, covered calls are best for high volatility stocks - think trendy stocks, tech stocks and growth stocks. I’m buying a call on a $50 stock that expires Friday with a strike price of $55 because I THINK it will be worth a lot more.

If I’m RIGHT, I can then buy the stock at $55, even though it’s $62 now. I immediately step into a profit. And you, the person selling the covered call, might be thinking: no way this stock hits $55 by Friday! I can earn a higher premium because of the volatility.

As a result, dividend stocks pay smaller premiums. The premium on, say, HIMS stock is dramatically higher than the premium on KO (Coca Cola) stock. Coca Cola barely moves anymore — that’s why they offer a dividend.

The pros of selling covered calls on dividend stocks is that you get a dividend AND you earn maybe a little extra income from the premium. These are lower volatility stocks, so there’s much less risk involved, your downside risk is lower because the premium gives you support if the stock drops, AND in sideways markets, you keep the premium and the dividend without the risk of losing your shares.

The downside of selling covered calls on Dividend Stocks: Smaller premiums AND the risk of EARLY ASSIGNEMENT.

If I buy a call that expires on Friday and I see the stock pays a dividend on Thursday and the ex-dividend date is Wednesday, I might say, assign those shares early so I qualify for the dividend!

Now, you lose your shares early AND you don’t get the most recent dividend.

If there is a highly trendy, highly volatile stock that RIPS, I try to ride that wave of momentum. I’ll buy the stock INTO the breakdown, sell a call, capture some premium and hope my shares actually DO get assigned. This isn’t something I necessarily want to hold for a long time.

If I see a stock that has already gone up a lot in a week, I AVOID buying the shares. Yeah, the premium could be very high. But the risk is that the stock drops very hard.

Buying at $18.55 is the worst move in my opinion. What I’d rather do is give the stock a week or two to sell off or consolidate (trade sideways). If I see some breakouts and some increased volume, then I’ll jump back in, buy it and sell a call.