Are THESE The BEST Dividend Stocks?

Dividends can be a great tool to help insulate your portfolio against market volatility, economic downturns, and recessions. When you enable DRIP (dividend reinvestment plan), you can take advantage of compounding over decades, earning you even MORE money in retirement.

Of course, dividend stocks aren’t the only tool to insulate your portfolio. There are bonds, CDs, Money Market Funds, and even just high yield savings accounts. But today, we’re gonna focus on dividends.

Not a fan of owning individual stocks? You can use my ETF comparison template to compare some of the ETFs listed below to find a good dividend ETF for your portfolio. ETFs are super easy to invest in - they basically handle it all for you: no management of the portfolio, extremely low fees, and some even pay monthly with annual yields of around 4%.

There are around 16 major dividend ETFs. I’m going to use their #1 holding (or 2nd if the first is the same) to put together a massive stock based passive income portfolio just in case you’re not an ETF kinda person.

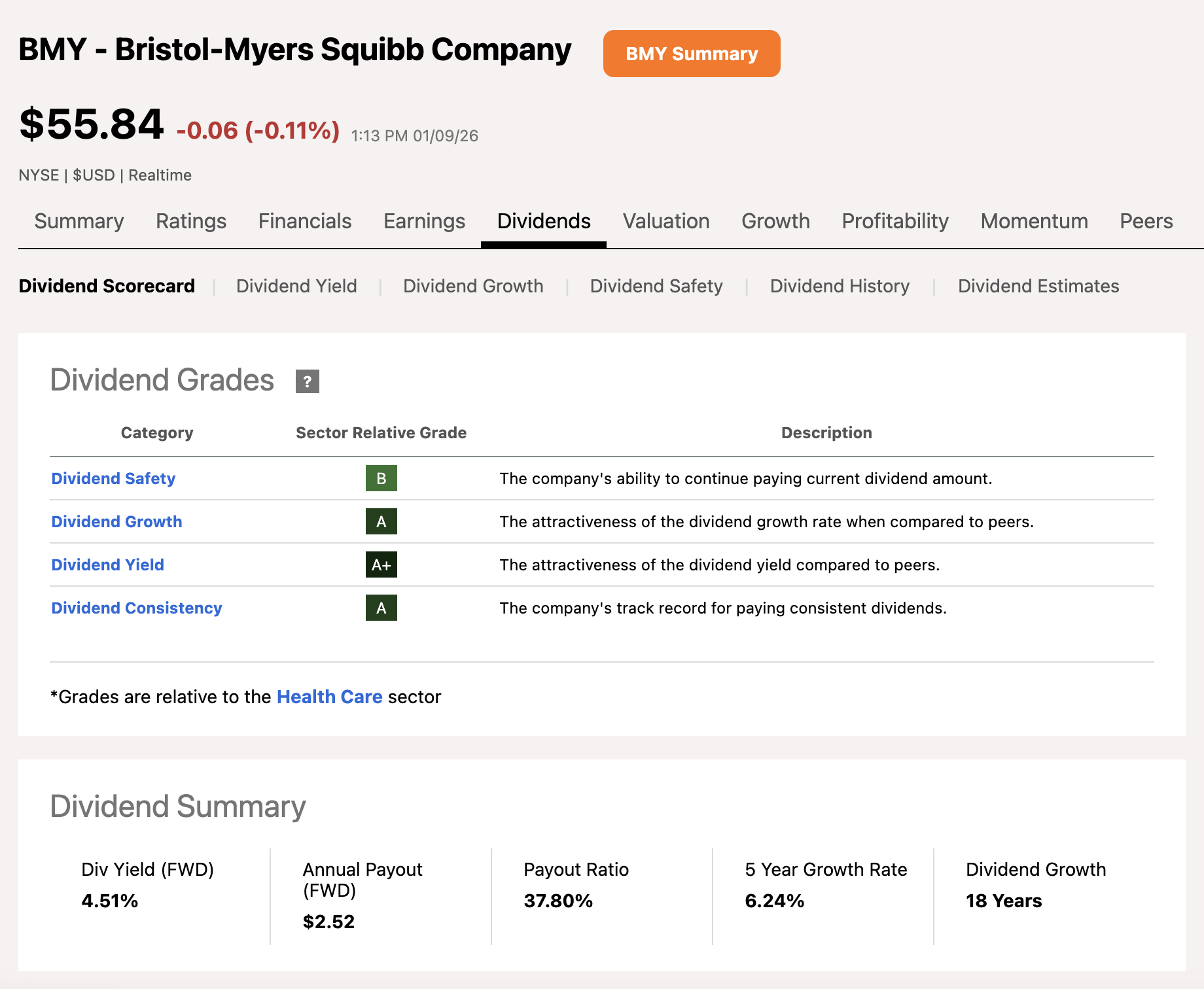

SCHD: BMY

This is what the dividend safety rating page looks like on Seeking Alpha. If you want to try it, it’s available with their premium service only and there’s a link at the bottom of the list!

VYM: AVGO

VIG: MSFT (2nd)

DGRO: XOM

SDY: VZ

DVY: F

HDV: CVX (2nd)

NOBL: ALB

RDVY: LRCX

DGRW: AAPL (2nd)

FNDX: GOOGL (3rd)

SPYD: CVS

IDV: BTI

WDIV: APA

SPHD: PFE

DIV: AMBP

So, do you just buy all of these? No - this list isn’t financial advice and many of these aren’t traditional dividend stocks anyway (big tech, for example).

You want to consider stuff like the dividend safety grade (if you’re using Seeking Alpha), payout ratio (anything over 60% is either very high risk or indicates that the company won’t be doing dramatic dividend increases any time soon), dividend growth (25+ years = dividend aristocrats, 50+ years = dividend king), and 5 year growth rate (have they been raising or cutting).

You should also use my fundamental analysis template to get a good idea on whether the company is fundamentally in a good place re: earnings, cash flow, cash on hand, etc.).

By the way: This is by no means a definitive list. There are LOTS of other great dividend stocks out there. People like JNJ, PG, MO, SO, MCD, KO, PEP, etc. It’s just a starting point. If you don’t see your favorite dividend stock here, it doesn’t mean your stock is bad or that this list sucks.

If you wanna learn more about dividends, use my guide here.