Boring Guide to Investing for (an early) Retirement

This is the ultimate guide to boring investing, broken down by age and potential risk tolerance. Consider this your primer for investing, especially if you’re a beginner. A portfolio can adjust and change as you get older, adding in risk, individual stocks, or other investments like gold, crypto, real estate, collectibles, etc.

Today, we’re focusing ENTIRELY on the stock market.

The foundation should be the measuring stick of building long term wealth: the stock market. It sounds boring until you’re 40 and realize you can do something most people can’t at that age: You can see early retirement coming.

When you’re 20, with a goal of retiring by 60 (50 if you’re lucky), you need to do two things. Open a Roth IRA (assuming you have a job) and an individual account (that you can do the second you turn 18). Younger? Ask your parents to open a custodial account.

HOW MUCH TO INVEST?

The running theme here will be to invest consistently every single month. The easiest thing about these breakdowns in option 1 & 2 is that you can take the percentage of investments in each fund and invest your money with the same percentage.

For example, obviously if you had $100 to invest and your only investment was the S&P 500, you’d invest that $100 into the S&P 500 every month.

If you had $1,000 to invest every month with Option 2, you could do $500 into the tech fund, $300 into the S&P 500, and $200 into the dividend fund.

OPTION 1: EASIEST/LOW RISK

You should consider an SP500 ETF. SPYM, SPY, VOO - they are all the same. You only need one. Focus on the one that has the lowest expense ratio (the fees the fund charges - don’t worry, you aren’t billed). You can find the expense ratio on any finance site, like yahoo finance, google finance, or Seeking Alpha.

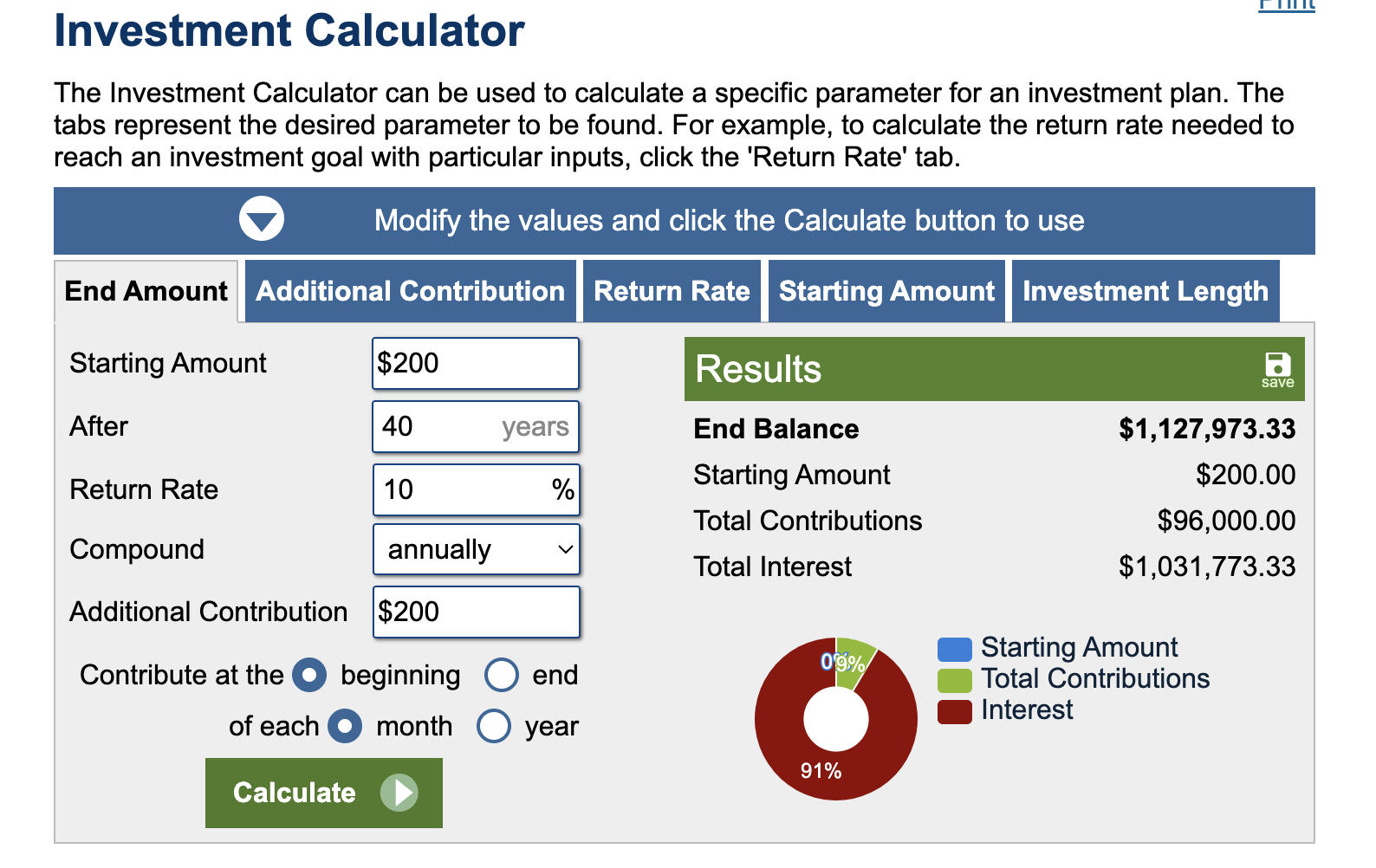

If you use this calculator, you can see that with $250 a month you can retire a millionaire by 60. If you want faster returns, more wealth, etc. you need to do something else: Get a higher paying job, side hustle, take on more risk (safely).

Consider focusing exclusively on the S&P 500. It gives you consistent returns over time and broad market exposure. And that $250 per month can grow over time as you earn more money, cut down on living expenses, etc.

I know 20 year olds are saying, “I don’t have an extra $250 per MONTH to invest!” I hear you, but I promise, you’ll look back when you’re 40 and kick yourself for not finding the laziest side hustle (picking up dog poop in your neighborhood: $20 per yard x 10 yards = $200 PER SUNDAY).

If you wanted the same $1,000,000 but you started investing at 40, you’d need to invest $1600 PER MONTH. Makes that $250 seem very doable, huh?

You’d never change a thing (unless you WANTED to), until you were in your mid-50s. You can check the guide below.

OPTION 2: SECOND EASIEST/SHORT TERM VOLATILE

This is my favorite. If I were 20 with a goal of retiring at 50, I’d be totally confident with riding short term waves of volatility. This means I’d go heavy technology.

My breakdown would look like this:

50% FTEC/SCHG/VGT (you only need one and you can use this free ETF template to compare)

30% S&P 500

20% Dividend ETF (something like SCHD/SPYD/SPHD - again, you only need one, adding extras is just redundant, you won’t get higher or better returns - you’ll just spread yourself too thin)

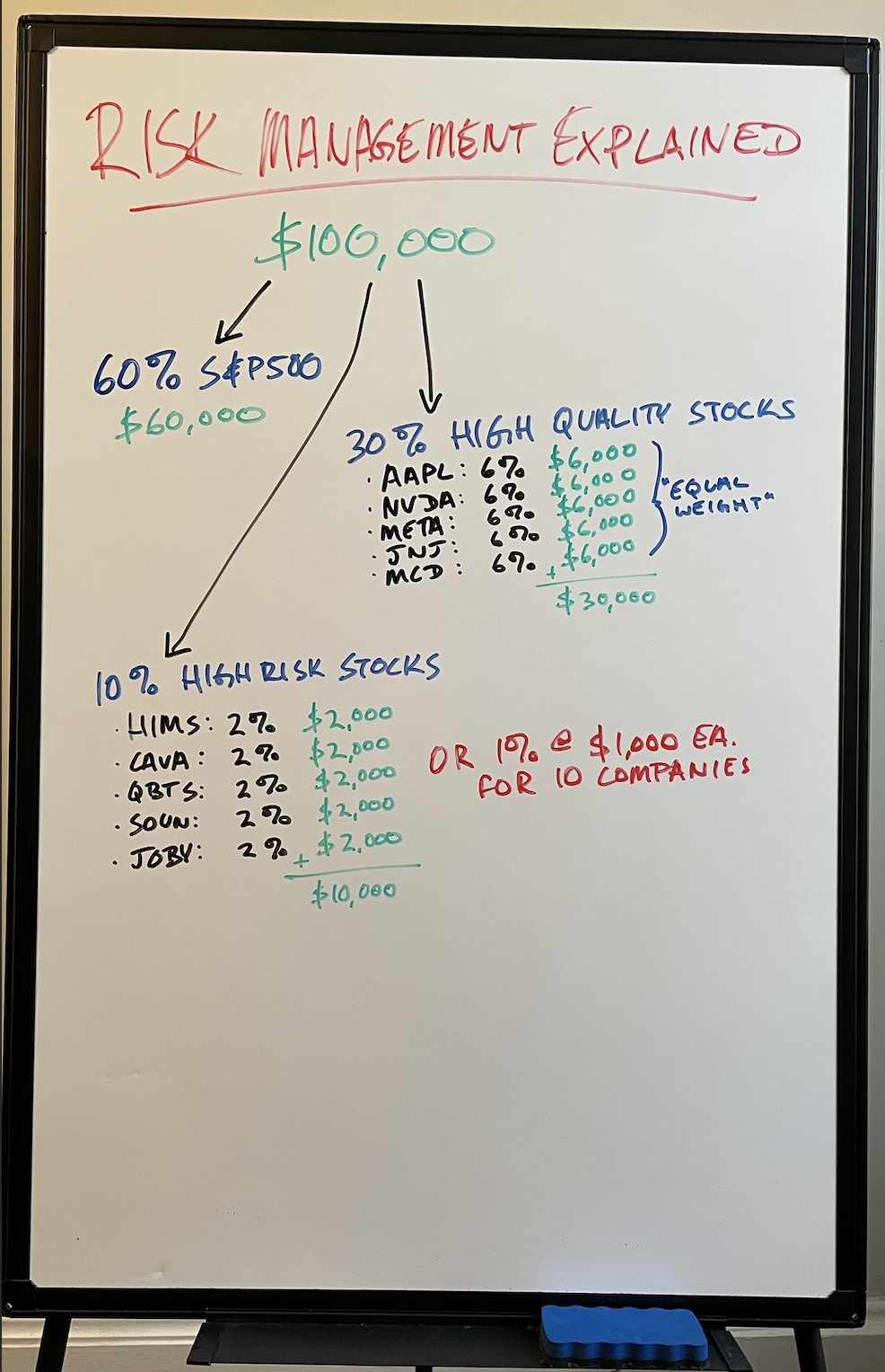

OPTION 3: COMPLICATED/HIGHER RISK

This option is higher risk and involves a more advanced investing strategy. Your foundation is still comprised of the big heavy hitting S&P 500. You could ALSO adjust the percentage if you wanted option 2 (a mix of ETFs), to do something like 30% S&P 500, 20% Technology, 10% dividend for example if you didn’t want high tech exposure):

This option require a lot more work - the stocks listed above are only examples and might be lousy investments for you depending on your risk tolerance/goals, or even just whenever you see this post.

Things change.

Speaking of which, when you add individual stocks to your portfolio, you need to keep an eye on ALL this stuff, adjusting your holdings, buying stuff, selling stuff, averaging down, cutting losses for riskier investments, etc. It can be a lot of work. It can also provide potentially higher returns. Key word: Potentially.

Remember, none of this is financial advice. It’s all just a template for you to get an idea. Now you take this ball and run with it. Learn.

Go through my actually free course for beginners.

Use my resource guide … and just browse everything under the menu in general. It’s all free.

GUIDE FOR INVESTING BY AGE

20-40 years old

50% FTEC

30% SPYM

20% SCHD

40-50 years old

40% FTEC

30% SPYM

20% SCHD

10% bonds

50+ years old

20% FTEC

20% SPYM

30% SCHD

30% bonds