GUIDE: How to Create a Recession Investing Wishlist

The biggest mistake new investors make is they might have a list of stocks they’re interested in (or they might not) and they write down their wishlist: these are the stocks I’ll buy when there’s a recession!

Mistake.

We don’t know when the next recession will be. We do know there will be one, because we have recessions every 6-10 years. So imagine you formulate this wishlist of high quality stocks and maybe a handful of speculative stocks and then they have a run up for five years, going up 100-500% in that time, but you kept waiting waiting waiting for the recession.

So the first step is to realize waiting IS a loser’s game.

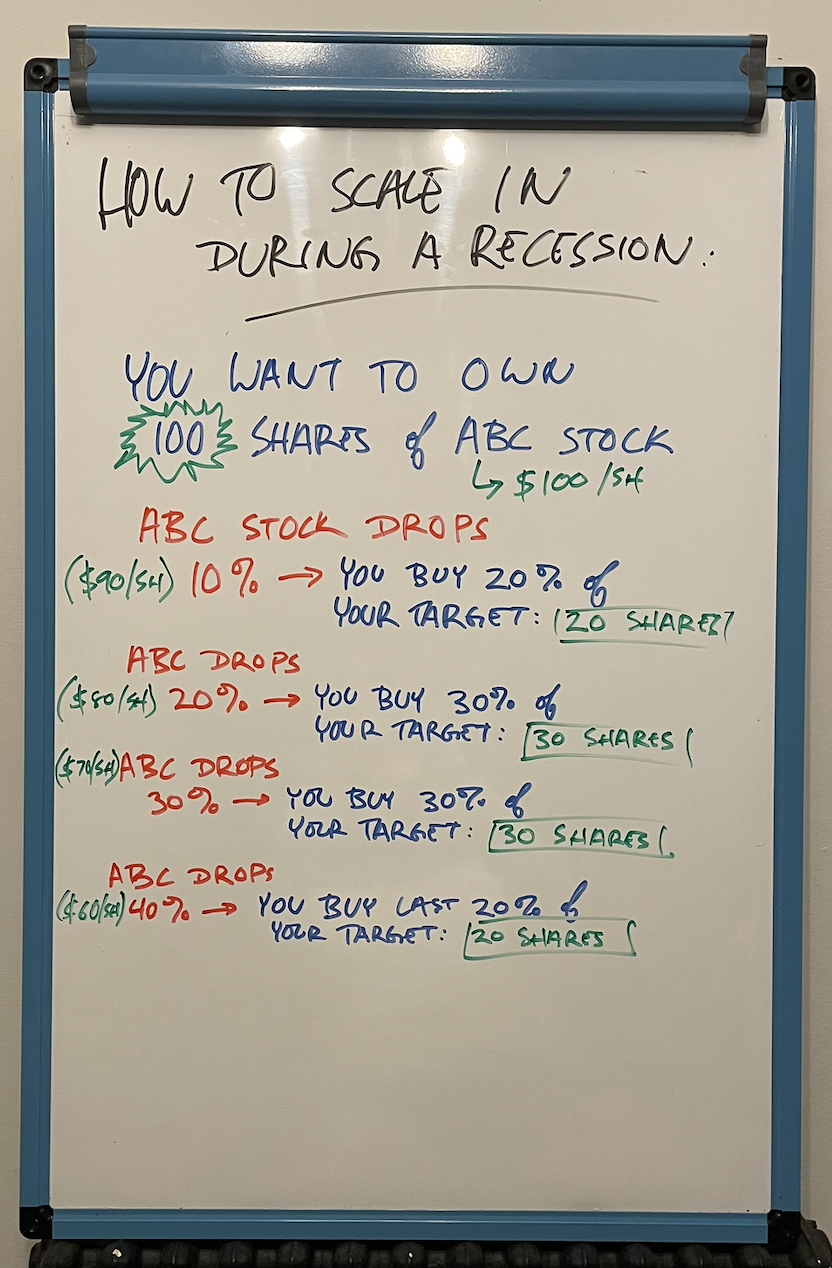

The best thing to consider is either dollar cost averaging (a little every month), lump sum investing (with a plan to take advantage of a huge economic downturn WHEN one comes), or a hybrid where you’d say, buy 50 shares now and then average in the other 50 by adding a few shares per month … with, again, a contingency plan to add more during a recession.

Your contingency plan might look something like this:

I can’t give YOU financial advice, but I can tell you how to start thinking about formulating your list.

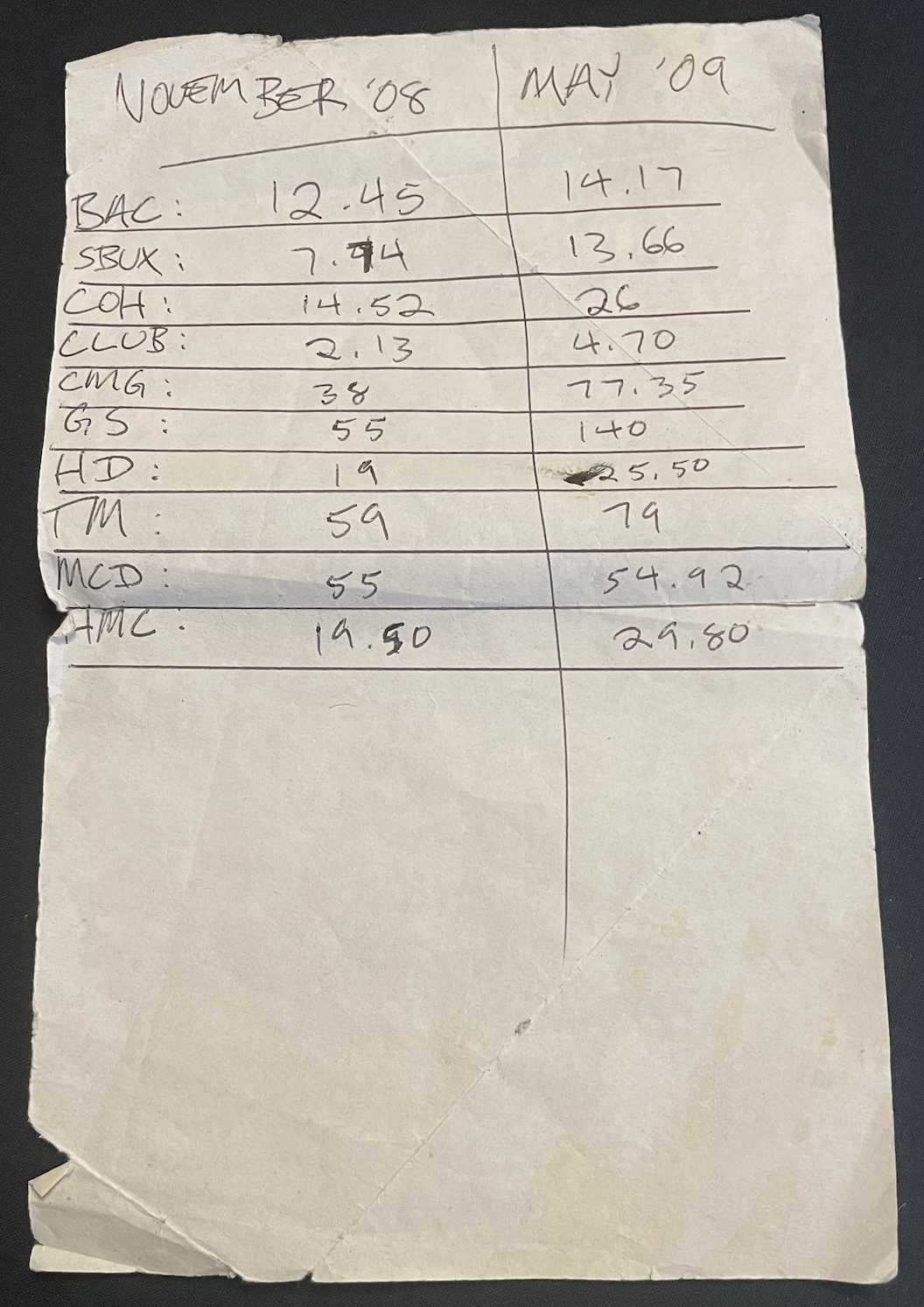

In 2008, when I wrote down my wishlist, I asked myself what companies I thought would be able to survive a recession, even if they were new companies. Could they ride out the storm? I put down some heavy hitters like Home Depot, but I also put down Chipotle, which I thought could be hit hard during a recession, but they weren’t some tiny little business that would be put out of business. So, they made the list, too.

You want to think about what companies could be impacted short term. Where might you stop going? What apps would you cancel if things got really difficult financially? Would you cut back anywhere? Hold off on any major purchases? Alternatively, are there any brands you’d maybe use even MORE?

Here are some quick thoughts:

I might stop going to Chipotle or CAVA. If I went to Starbucks, I might stop going there, too. But I wouldn’t stop forever, which means if a lot of people were temporarily planning on not going anymore, that stock might get hit pretty hard. Temporarily.

I might stop subscribing to Netflix or maybe downgrade my plan. If I’m thinking about doing that, chances are lots of people are, too. Hmm … Okay.

Maybe I’d make fewer trips to Whole Foods (an Amazon brand) or Walmart. Maybe I’d switch to the advertisement supported Spotify.

Maybe I’d decide to not get that new car after all.

But maybe I’d swing by Home Depot or Lowe’s and buy some tools. After all, I’m probably not getting any new appliances for a while, so what I have will have to be maintained and fixed if they break. I might have to go to Autozone to buy parts to fix my car.

Where would people go to eat quick affordable meals if they were on a budget? Yeah, we can complain that a McChicken isn’t a dollar anymore, but at $3, it’s still affordable. And McDonald’s does have those $5 meal deals now …

Banks might get hit during a recession, but the strong ones will make it through.

And what brands will you absolutely not stop using during a recession? Maybe you’re unfortunately addicted to cigarettes. Maybe drinking becomes a bad habit for many people during dark times. You definitely still need medicine, toilet paper, band-aids, soap, etc.

RESOURCES:

Fundamental Analysis Template

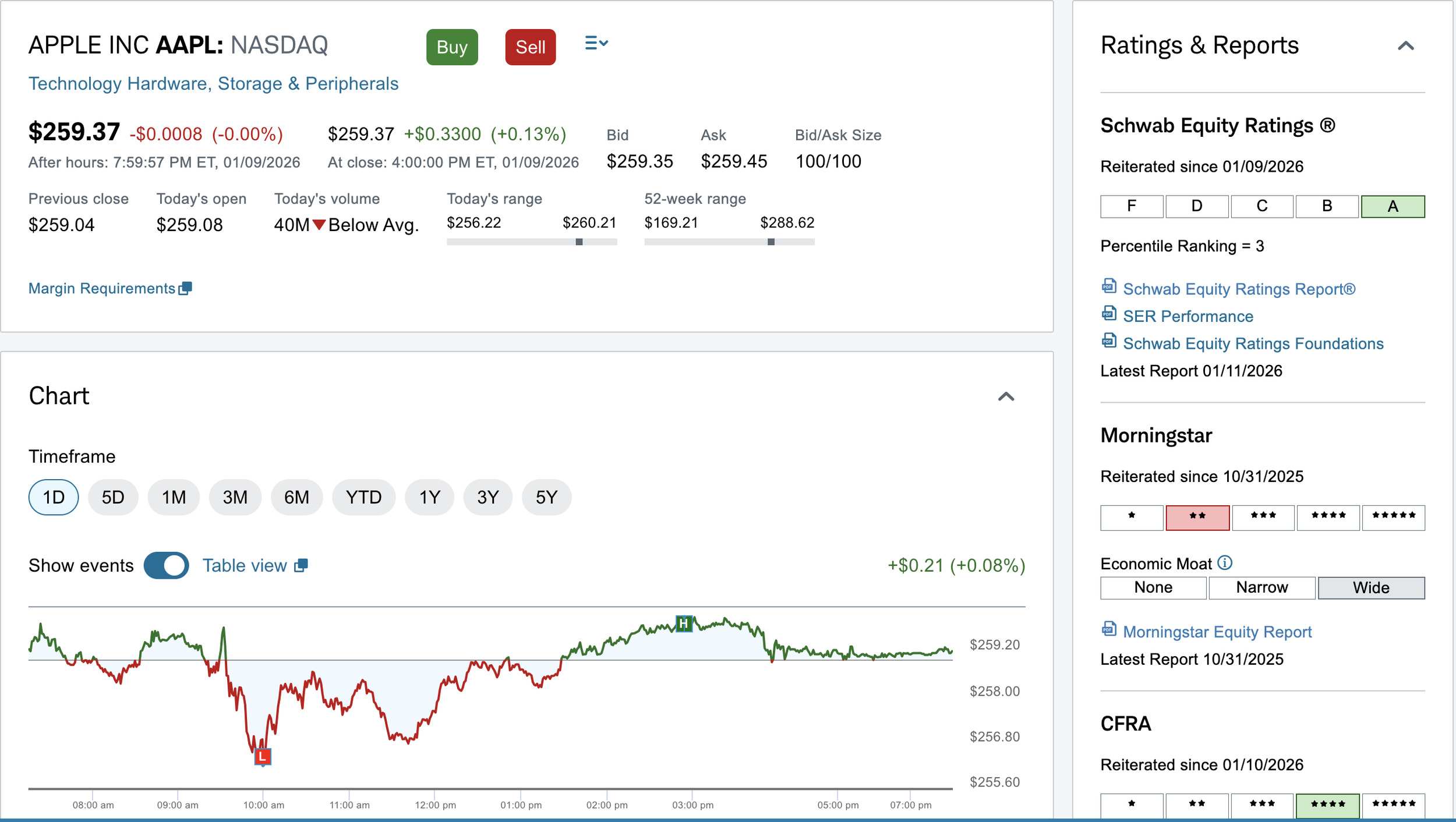

Your own brokerage accounts analyst reports - under SCHWAB, the analyst reports are to the right of any stock you’re searching for. Read them ALL - the bullish and bearish ones. You’re not looking for confirmation bias, you’re looking to be a well rounded investor. Know what the analysts are bullish and bearish on: